What separates Generation Y from X, and is Generation Z a thing? How old is each generation? Are they really that different? It’s easy to see why there is so much confusion about generational cohorts.

If you’ve ever felt muddled by this “alphabet soup” of names…you’re not alone. The real frustration hits when you realize that Gen Y consumers will earn 46% of income in the U.S. by 2025. And unless you understand who they are and what they want, you won’t capture a dollar of their money. Furthermore, as one generation’s spending power decreases (i.e. Boomers) another is increasing.

People Grow Older, Birthdays Stay the Same

A common source of confusion when labeling generations is their age. Generational cohorts are defined (loosely) by birth year, not current age. The reason is simple, generations get older in groups. If you think of all Millennials as college kids (18 – 22), then you are thinking of a stage in life and not a generation. Millennials are out of college and that life stage is now dominated by Gen Z.

Another example, a member of Generation X who turned 18 in 1998 would now be nearly 40. In that time, he or she cares about vastly different issues and is receptive to a new set of marketing messages. Regardless of your age, you will always belong to the generation you were born into.

As of 2019, the breakdown by age looks like this:

- Baby Boomers: Baby boomers were born between 1944 and 1964. They’re current between 55-75 years old (76 million in U.S.)

- Gen X: Gen X was born between 1965 – 1979 and are currently between 40-54 years old (82 million people in U.S.)

- Gen Y: Gen Y, or Millennials, were born between 1980 and 1994. They are currently between 25-39 years old.

- Gen Y.1 = 25-29 years old (31 million people in U.S.)

- Gen Y.2 = 29-39 (42 million people in U.S.)

- Gen Z: Gen Z is the newest generation to be named and were born between 1995 and 2015. They are currently between 4-24 years old (nearly 74 million in U.S.)

The term “Millennial” has become the popular way to reference both segments of Gen Y (more on Y.1 and Y.2 below).

Realistically, the name Generation Z is a place-holder for the youngest people on the planet. It is likely to morph as they leave childhood and mature into their adolescent and adult identities.

Why are generations named after letters?

It started with Generation X, people born between 1965-1979. The preceding generation was the Baby Boomers, born 1944-1964. Post World War II, Americans were enjoying new-found prosperity, which resulted in a “baby boom.” The children born as a result were dubbed the Baby Boomers.

But the generation that followed the Boomers didn’t have a blatant cultural identifier. In fact, that’s the anecdotal origin of the term Gen X — illustrating the undetermined characteristics they would come to be known by. Depending on whom you ask, it was either sociologists, a novelist, or Billy Idol who cemented this phrase in our vocabulary.

From there on it was all down-alphabet. The generation following Gen X naturally became Gen Y, born 1980-1994 (give or take a few years on either end). The term “Millennial” is widely credited to Neil Howe, along with William Strauss. The pair coined the term in 1989 when the impending turn of the millennium began to feature heavily in the cultural consciousness.

Generation Z refers to babies born from the mid-2000s through today, although the term isn’t yet widely used. This may signal the end of ‘alphabet soup’ (it does coincide with the literal end of the alphabet, after all). A flurry of potential labels has appeared, including Gen Tech, post-Millennials, iGeneration, and Gen Y-Fi.

Splitting Up Gen Y

Javelin Research noticed that not all Millennials are currently in the same stage of life. While all millennials were born around the turn of the century, some of them are still in early adulthood, wrestling with new careers and settling down, while the older millennials have a home and are building a family. You can imagine how having a child might change your interested and priorities, so for marketing purposes, it’s useful to split this generation into Gen Y.1 and Gen Y.2.

Not only are the two groups culturally different, but they’re in vastly different phases of their financial life. The younger group are financial fledglings, just flexing their buying power. The latter group has a credit history, may have their first mortgage and are raising toddlers. The contrast in priorities and needs is vast.

The same logic can be applied to any generation that is in this stage of life or younger. As we get older, we tend to homogenize and face similar life issues. The younger we are, the more dramatic each stage of life is. Consider the difference between someone in elementary school and high school. While they might be the same generation, they have very different views and needs.

Marketing to young generations as a single cohort will not be nearly as effective as segmenting your strategy and messaging.

Why are generation cohort names important?

Each generation label serves as a short-hand to reference nearly 20 years of attitude, motivations, and historic events. Few individuals self-identify as Gen X, Millennial, or any other name.

They’re useful terms for marketers and have a tendency to trickle down into common usage. Again, it’s important to emphasize that referring to a cohort simply by the age range gets complicated quickly. 10 years from now, the priorities of Millennials will have changed — and marketing tactics must adjust instep.

Whatever terminology you use, the goal is to reach people with marketing messages that are relevant to their phase of life. In short, no matter how many letters get added to the alphabet soup, the most important thing you can do is seek to understand the soup du jour for the type of consumer you want to attract.

What makes each generation different?

Before we dive into each generation, remember that the exact years born are often disputed, but this should give you a general range to help identify what generation you belong in.

The other fact to remember is that new technology is typically first adopted by the youngest generation and then is gradually adopted by the older generations. As an example, 95% of Americans have a smartphone, but Gen Z (the youngest generation) is the highest user.

The Baby Boomer Generation

- Boomer Birth Years: 1944 to 1964

- Current Age: 55 to 75

- Generation Size: 76 Million

- Media Consumption: Baby boomers are the biggest consumers of traditional media like television, radio, magazines, and newspaper. Despite being so traditional 90% of baby boomers have a Facebook account. This generation has begun to adopt more technology in order to stay in touch with family members and reconnect with old friends.

- Banking Habits: Boomers prefer to go into a branch to perform transactions. This generational cohort still prefers to use cash, especially for purchases under $5.

- Shaping Events: Post-WWII optimism, the cold war, and the hippie movement.

- What’s next on their financial horizon: This generation is experiencing the highest growth in student loan debt. While this might seem counter intuitive, it can be explained by the fact that this generation has the most wealth and is looking to help their children with their student debt. They have a belief that you should take care of your children enough to set them on the right course and don’t plan on leaving any inheritance. With more Americans outliving their retirement fund, declining pensions, and social security in jeopardy, ensuring you can successfully fund retirement is a major concern for Boomers.

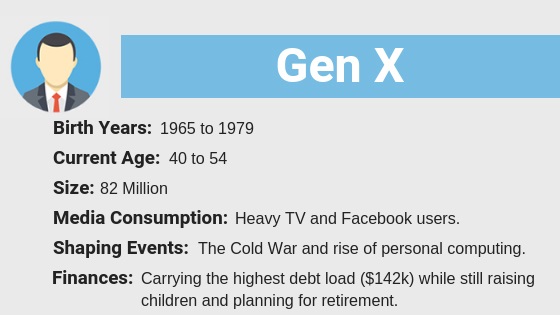

Generation X

- Gen X Birth Years: 1965 to 1979

- Current Age: 40 to 54

- Other Nicknames: “Latchkey” generation, MTV generation

- Generation Size: 82 Million

- Media Consumption: Gen X still reads newspapers, magazines, listens to the radio, and watches TV (about 165 hours worth of TV a month). However, they are also digitally savvy and spend roughly 7 hours a week on Facebook (the highest of any generational cohort).

- Banking Habits: Since they are digitally savvy, Gen X will do some research and financial management online, but still prefer to do transactions in person. They believe banking is a person-to-person business and demonstrate brand loyalty.

- Shaping Events: End of the cold war, the rise of personal computing, and feeling lost between the two huge generations.

- What’s next on Gen X’s financial horizon: Gen X is trying to raise a family, pay off student debt, and take care of aging parents. These demands put a high strain on their resources. The average Gen Xer carries $142,000 in debt, though most of this is in their mortgage. They are looking to reduce their debt while building a stable saving plan for the future.

Millennials (Gen Y)

- Millennial Birth Years: 1980 to 1994

- Current Age: 25 to 39

- Other Nicknames: Gen Y, Gen Me, Gen We, Echo Boomers

- Generation Size: 95 Million

- Media Consumption: 95% still watch TV, but Netflix edges out traditional cable as the preferred provider. Cord-cutting in favor of streaming services is the popular choice. This generation is extremely comfortable with mobile devices but 32% will still use a computer for purchases. They typically have multiple social media accounts.

- Banking Habits: Millennials have less brand loyalty than previous generations. They prefer to shop product and features first and have little patience for inefficient or poor service. Because of this, Millennials place their trust in brands with superior product history such as Apple and Google. They seek digital tools to help manage their debt and see their banks as transactional as opposed to relational.

- Shaping Events: The Great Recession, the technological explosion of the internet and social media, and 9/11

- What’s next on their financial horizon: Millennials are entering the workforce with high amounts of student debt. This is delaying major purchases like weddings and homes. Because of this financial instability, Millennials prefer access over ownership which can be seen through their preference for on-demand services. They want partners that will help guide them to their big purchases.

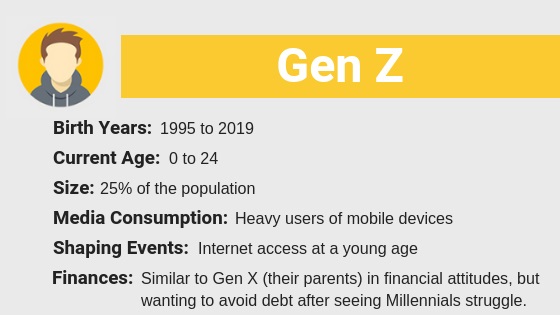

Gen Z

- Gen Z Birth Years: 1995 to 2019

- Currently Aged: 4 to 24

- Other Nicknames: iGeneration, Post-millennials, Homeland Generation

- Generation Size: Roughly 25% of the population

- Media Consumption: The average Gen Zer received their first mobile phone at age 10.3 years. Many of them grew up playing with their parents’ mobile phones or tablets. They have grown up in a hyper-connected world and the smartphone is their preferred method of communication. On average, they spend 3 hours a day on their mobile device.

- Banking Habits: This generation has seen the struggle of Millennials and has adopted a more fiscally conservative approach. They want to avoid debt and appreciate accounts or services that aid in that endeavor. Debit cards top their priority list followed by mobile banking. Over 50% have not entered a bank branch in at least 3 months.

- Shaping Events: Smartphones, social media, never knowing a country not at war, and seeing the financial struggles of their parents (Gen X).

- What’s next on Gen Z’s financial horizon: Learning about personal finance. They have a strong appetite for financial education and are opening savings accounts at younger ages than prior generations.

If you want to know more about Gen Z, check out this deep dive into their media consumption and banking habits.

Do Generations Bank Differently?

Absolutely, and for several reasons.

- Each generation has been in the workforce for different lengths of time and accumulated varying degrees of wealth.

- Baby Boomers have an average net worth of $1,066,000 and a median net worth of $224,000.

- GenXers average net worth is around $288,700, but the median is $59,800.

- Millennials have an average net worth around $76,200, but their median net worth is only $11,100.

- Gen Z’s average net worth is difficult to report on since so much of the generation has no net worth or career.

- Each generation is preparing and saving for different life stages; be that retirement, children’s college tuition, or buying a first car.

- Each generation grew up in evolving technological worlds and has unique preferences in regard to managing financial relationships.

- Each generation grew up in different financial climates, which has informed their financial attitudes and opinions of institutions.